About Our Blog

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.

2021 Fair Lending Hot Topics and Completing the Regression Analysis

The Party Is Over: The CFPB Rescinds Pandemic Discretions

Effective April 1 the CFPB rescinded its exercise of supervisory and enforcement discretion during the pandemic and announced its intent to carry out its supervisory and enforcement authority consistent with the statutory purpose and objectives of the Bureau. Furthermore, when conducting exams and other supervisory activities, the Bureau would consider …Read More »Chopra Vows to Revive Enforcement at CFPB

The following comments are extracted from a press release describing remarks made by Rohit Chopra at his confirmation hearing. “President Joe Biden’s CFPB nominee Rohit Chopra said the agency will have a much more aggressive enforcement unit in areas such as fair lending and mortgage servicing if he wins Senate …Read More »Acting Assistant Director Dave Ueijo

In late January the CFPB announced that Rohit Chopra was being nominated to replace Kathy Kraninger as Director of the CFPB. In the interim between that announcement and today, an Acting Assistant Director, Dave Ueijo, has been appointed. In his memo to the CFPB staff Ueijo made several comments that …Read More »Fair Lending Regression Analysis & What Compliance Officers Need to Understand Part II

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »Fair Lending Regression Analysis & What Compliance Officers Need to Understand Part I

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »Understanding Fair Lending Regression Analysis

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »Understanding Non-Regression Statistics

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »Statistical Analysis and Modeling for Risk Assessment

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here. Read More »Redlining: What Can You Do to Prevent It

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »Narrowing the Exceptions

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »Fair Lending Risk Assessment: Determining Your Risk Exposure

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here. Read More »A Primer on Fair Lending Modeling

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »Cracking the Black Box

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »Risk Assessment Analytics: Understanding Fair Lending Statistical Analysis

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »Fair Lending and Data Analytics: You Do Not Have to Be an Expert to Get It Right

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »A Tool for Explaining Lending Differences: Understanding Fair Lending Statistical Analysis

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »What About Redlining?

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here. Read More »Fair Lending and Data Analytics: You Do Not Need to Be an Expert to Get It Right

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »Statistical Analysis for Community Banks

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here. Read More »Managing Discretionary Pricing Risks

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »How to Assess Redlining Risk by Analyzing Peers

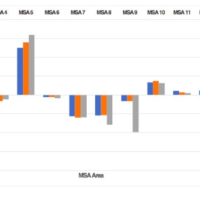

By Arthur R. Preiss, Ph.D. and Philip B. Preiss Unless you’ve been hiding under a rock, you know that redlining is a key focus of the regulators in 2017. Redlining is the practice of discouraging applicants or denying loans in specific geographic locations. This article discusses one aspect of how …Read More »How Model Risk Management Can Play a Leading Role in Compliance

By Arthur R. Preiss, PhD., and Stephen E. Sudhoff, CFA Models help us think about our world in a structured way. As credit products have become more complex and computing power has become cheaper and more accessible, analysis of more complex relationships has become easier. And, as our world has become …Read More »What Is a Peer Bank?

What is a peer bank? A seemingly simple question that has become anything but simple to answer. Peer banks are a hugely important item that can vastly affect the portrayal of your institution, and thus it is paramount that when you define an institution as a “Peer Bank,” you are …Read More »Redlining: A Compliance Officer’s Primer

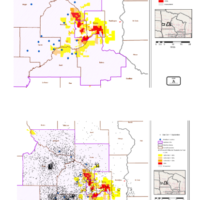

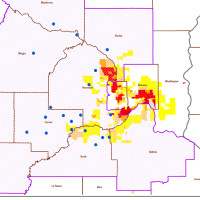

In today’s regulatory environment, most compliance officers are keenly aware of the fact that redlining is one of three 2017 foci for the CFPB and probably for the prudential regulators as well. The purpose of this article is to highlight the key elements in any redlining analysis and thereby make …Read More »An Introduction to Fair Lending Marginal Effects for Financial Institutions

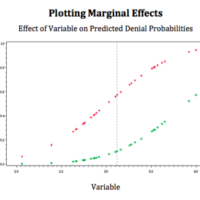

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here. Read More »Marginal Effects: You May Not Know Me But Your Regulator Does

Marginal effects are a regression-based process, used for many years as an analytical tool. The Consumer Financial Protection Bureau (CFPB) has been and continues to use marginal effects in its fair lending exams. Aside from the fact that regulators utilize marginal effects in their exams, financial institutions may choose to …Read More »Alternate Credit Scoring Models: FICO vs. Vantage Models

According an article in the Wall Street Journal, on August 13, the Federal Housing Finance Agency (HFHA), which supervises Fannie Mae and Freddie Mac, has sent to the Federal Register for publication a final rule on the validation and approval of third party credit score models that can be used …Read More »CFPB Releases Complaint Data by State

Recently the Consumer Finance Protection Bureau released a special edition of its monthly complaint report that provided a unique look at the way the Bureau compiles national data on the complaints it receives. Since July 2015, the CFPB has released monthly reports that summarize the complaints it collects on consumer …Read More »Understanding the CFPB’s Expectations through Enforcement

Once a quarter, the Consumer Finance Protection Bureau publishes a report of actions it’s taken to enforce compliance matters across the spectrum of consumer finance products. This report, called Supervisory Highlights, often contains valuable insights into how the Bureau is collecting, interpreting and acting on the data it collects. And …Read More »Changes Are Coming to Small Business Lending

In the Consumer Finance Protection Bureau’s Annual Fair Lending Report released earlier this year, the CFPB announced it is close to finalizing rule changes regarding the collection and reporting of data on small business lending. “Because small businesses are the backbone of our economy,” Patrice Ficklin, director of the office …Read More »Changes Are Coming to Small Business Lending

In the Consumer Finance Protection Bureau’s Annual Fair Lending Report released earlier this year, the CFPB announced it is close to finalizing rule changes regarding the collection and reporting of data on small business lending. “Because small businesses are the backbone of our economy,” Patrice Ficklin, director of the office …Read More »Peer! Peer! Who Is Your Peer?

The Fall 2016 edition of the Consumer Finance Protection Bureau’s Supervisory Highlights devoted several pages to the topic of redlining. Some of what the CFPB had to say about fair lending was not new—for example, that “redlining is a priority area in the Bureau’s supervisory work” or that “redlining is a form …Read More »The DOJ Alleges Redlining at KleinBank

This week the Justice Department filed yet another suit alleging a financial institution unfairly excluded – or “redlined” — majority-minority neighborhoods from its lending services. The suit against Minnesota-based KleinBank alleges that between 2010 and 2015, KleinBank conducted its residential mortgage lending in a manner that avoided extending credit to …Read More »Preiss&Associates’ Guide to Fair Lending in 2017

What does the year have in store for fair lending and compliance professionals? Some speculate that the new year and new administration could bring big changes — perhaps reduced authority or even a new structure for the Consumer Finance Protection Bureau. But if you ask the CFPB, their priorities are …Read More »REMA: Reasonably Expected Market Area

Recently I attended a seminar where a Federal Deposit Insurance Corporation representative used the term “REMA” in a discussion of redlining risk. Have you heard the term? It’s a helpful acronym to know if you desire to understand how the FDIC makes determinations about redlining. What follows borrows heavily from the FDIC …Read More »Charter Bank Fair Lending Settlement with the Department of Justice

The Department of Justice and Charter Bank of Corpus Christi, Texas have announced the settlement of the fair lending suit referred to the DOJ by the Federal Deposit Insurance Corporation. This suit is one of a long line of fair lending legal actions brought by regulators. While the provisions of the …Read More »Mystery Shoppers Expose Alleged Redlining at BancorpSouth

This month yet another financial institution has entered into a consent order with the Department of Justice and Consumer Finance Protection Bureau over allegations of discriminatory mortgage lending practices. BancorpSouth Bank, headquartered in Tupelo, Miss., is accused of: Structuring their lending area to avoid and/or discourage mortgage applications from consumers …Read More »A Closer Look at the CFPB’s Annual Report Part III: New HMDA Rules and Interagency Coordination

In early May, the Consumer Finance Protection Bureau released its Annual Report on fair lending activities during 2015. The report provides a thorough and detailed look at each of the actions the Bureau took in the last year, its current methodologies for identifying and pursuing fair lending cases and pending …Read More »A Closer Look at the CFPB’s Annual Report Part II: Actions and Enforcement

Note: This blog is the second in a three-part series exploring the Consumer Finance Protection Bureau’s 2015 Fair Lending Report. The recently released Consumer Finance Protection Bureau’s 2015 report contained detailed insights into settlements and actions that resulted in approximately $108 million in payments to consumers and advocacy groups by lenders. …Read More »A Closer Look at the CFPB’s Annual Report Part I: Approaches to Enforcement

Note: This blog is the first in a three-part series exploring the Consumer Finance Protection Bureau’s 2015 Fair Lending Report. Earlier this month the Consumer Finance Protection Bureau released its annual report of supervisory and enforcement action. The 2015 report includes insights into a number of high-profile actions the Bureau …Read More »“Whether Intentional or Not” – Learning from the Fidelity Bank Settlement

Last week yet another mortgage lender settled allegations of discriminatory lending against minority applicants. North Carolina-based Fidelity Bank agreed to spend $1 million dollars over the course of two years to boost lending in predominantly minority census tracts. Fidelity will also provide fair lending training to staff – including loan …Read More »Redlining Allegations against First Federal Bank of Kansas City

Last week the First Federal Bank of Kansas City became the latest financial institution to settle redlining allegations after the Metropolitan St. Louis Equal Housing and Opportunity Council (EHOC) and Legal Aid of Western Missouri alleged that the bank’s service area was designed in a way that excluded areas of …Read More »Seasons Greetings from Preiss&Associates

Sage Bank: Some Fair Lending Compliance Take-Aways

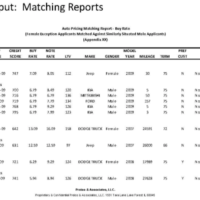

Once again the Justice Department has filed a complaint alleging discrimination by a residential mortgage lender. In a recently proposed consent order, the DOJ has accused Sage Bank, based in Lowell, Mass., of a pattern of discriminatory pricing that disproportionately impacted African-American and Hispanic borrowers. “Sage Bank’s loan pricing policies …Read More »A Look Inside the FFIEC Mortgage Lending Data

The Federal Financial Institutions Examination Council recently released a treasure trove of data on mortgage lending transactions at U.S. financial institutions covered by the Home Mortgage Disclosure Act in 2014. The data include applications, originations, purchases and sales of loans, denials and other actions from more than 7,000 banks, savings …Read More »Wells Fargo & Minimum Credit Scores for FHA Loans: What You Should Know

In a move aimed at deterring scrutiny from the Justice Department, Wells Fargo –the largest home loan lender in the United States – has raised the minimum credit score requirements for Federal Housing Administration (FHA) loans. In 2014, Wells Fargo had lowered credit score requirements to 600. Now borrowers will …Read More »The Consequences of Redlining: Hudson City Savings Bank

Less than a month ago the Department of Justice and Consumer Finance Protection Bureau pledged to work in cooperation to fight what they saw as a resurgence of redlining cases. It seems that they have kept their promise. In a recently released consent order, the DOJ and CFPB have ordered …Read More »Redlining is Back: Keeping Steve and Patrice Away

“Redlining is making a comeback…” So said Steve Rosenbaum, chief of Housing and Civil Enforcement in the DOJ’s civil rights division, at a recent HUD hosted fair housing conference. The conference, attended by a number of DOJ, CFPB and HUD officials, highlighted the DOJ and CFPB’s cooperation in pursuing fair …Read More »Insights into the August 2015 CFPB Complaint Snapshot

Since the Consumer Finance Protection Bureau was created as a part of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2011, a key component of its work has been handling consumer complaints from across the country. Each month the CFPB releases a snapshot of these complaints (You can …Read More »