Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.

The Party Is Over: The CFPB Rescinds Pandemic Discretions

Effective April 1 the CFPB rescinded its exercise of supervisory and enforcement discretion during the pandemic and announced its intent to carry out its supervisory and enforcement authority consistent with the statutory purpose and objectives of the Bureau. Furthermore, when conducting exams and other supervisory activities, the Bureau would consider the circumstances banks might have […]Read More »Chopra Vows to Revive Enforcement at CFPB

The following comments are extracted from a press release describing remarks made by Rohit Chopra at his confirmation hearing. “President Joe Biden’s CFPB nominee Rohit Chopra said the agency will have a much more aggressive enforcement unit in areas such as fair lending and mortgage servicing if he wins Senate confirmation to the post.” “Chopra […]Read More »Acting Assistant Director Dave Ueijo

In late January the CFPB announced that Rohit Chopra was being nominated to replace Kathy Kraninger as Director of the CFPB. In the interim between that announcement and today, an Acting Assistant Director, Dave Ueijo, has been appointed. In his memo to the CFPB staff Ueijo made several comments that compliance officers should be aware […]Read More »Charter Bank Fair Lending Settlement with the Department of Justice

The Department of Justice and Charter Bank of Corpus Christi, Texas have announced the settlement of the fair lending suit referred to the DOJ by the Federal Deposit Insurance Corporation. This suit is one of a long line of fair lending legal actions brought by regulators. While the provisions of the settlement contain some familiar provisions, […]Read More »Mystery Shoppers Expose Alleged Redlining at BancorpSouth

This month yet another financial institution has entered into a consent order with the Department of Justice and Consumer Finance Protection Bureau over allegations of discriminatory mortgage lending practices. BancorpSouth Bank, headquartered in Tupelo, Miss., is accused of: Structuring their lending area to avoid and/or discourage mortgage applications from consumers in minority areas (also known […]Read More »A Closer Look at the CFPB’s Annual Report Part I: Approaches to Enforcement

Note: This blog is the first in a three-part series exploring the Consumer Finance Protection Bureau’s 2015 Fair Lending Report. Earlier this month the Consumer Finance Protection Bureau released its annual report of supervisory and enforcement action. The 2015 report includes insights into a number of high-profile actions the Bureau took last year – several […]Read More »“Whether Intentional or Not” – Learning from the Fidelity Bank Settlement

Last week yet another mortgage lender settled allegations of discriminatory lending against minority applicants. North Carolina-based Fidelity Bank agreed to spend $1 million dollars over the course of two years to boost lending in predominantly minority census tracts. Fidelity will also provide fair lending training to staff – including loan originators, processors and underwriters – […]Read More »Redlining Allegations against First Federal Bank of Kansas City

Last week the First Federal Bank of Kansas City became the latest financial institution to settle redlining allegations after the Metropolitan St. Louis Equal Housing and Opportunity Council (EHOC) and Legal Aid of Western Missouri alleged that the bank’s service area was designed in a way that excluded areas of high African American population. A […]Read More »Sage Bank: Some Fair Lending Compliance Take-Aways

Once again the Justice Department has filed a complaint alleging discrimination by a residential mortgage lender. In a recently proposed consent order, the DOJ has accused Sage Bank, based in Lowell, Mass., of a pattern of discriminatory pricing that disproportionately impacted African-American and Hispanic borrowers. “Sage Bank’s loan pricing policies created the risk that borrowers […]Read More »Wells Fargo & Minimum Credit Scores for FHA Loans: What You Should Know

In a move aimed at deterring scrutiny from the Justice Department, Wells Fargo –the largest home loan lender in the United States – has raised the minimum credit score requirements for Federal Housing Administration (FHA) loans. In 2014, Wells Fargo had lowered credit score requirements to 600. Now borrowers will need to have a minimum […]Read More »The Consequences of Redlining: Hudson City Savings Bank

Less than a month ago the Department of Justice and Consumer Finance Protection Bureau pledged to work in cooperation to fight what they saw as a resurgence of redlining cases. It seems that they have kept their promise. In a recently released consent order, the DOJ and CFPB have ordered Hudson City Savings Bank – […]Read More »Fair Lending Regression Analysis: Some Frequently Asked Questions

Fair Lending Regression Analysis: Some Frequently Asked Questions Whether you use regression analysis in your fair lending monitoring program or you are thinking about using it, a few regression related questions are asked regularly. This blog will discuss four of the more popular questions. What data do I need? Depending on whether you are going […]Read More »Lessons in Fair Lending: Santander Holdings USA, Inc.

Last week the Federal Reserve Bank of Boston released the written agreement between Santander Holdings USA, Inc. and the Federal Reserve Bank. There are at least two things about this document that are noteworthy: (1) the level of detailed requirements and (2) the fact that the Boston Fed Bank made this level of detail public. […]Read More »Data Driven Regulation: What It Means for Fair Lending Compliance

The Consumer Finance Protection Bureau prides itself on being a data driven organization when it comes to fair lending compliance. What does that mean for a compliance officer? More importantly, what does it mean for your next fair lending compliance exam? Does it mean more number crunching? In part, yes, but it also means much […]Read More »Insights into the DOJ 2014 Annual Report on Equal Credit Opportunity Act Referrals

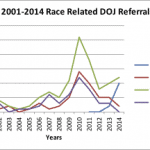

This week the Department of Justice published its Equal Credit Opportunity Act or ECOA annual report to Congress. Some of the data in the report makes for interesting reading. A Look at the Numbers For 2014 DOJ received 18 referrals from the various agencies (CFPB, FDIC, FRB, OCC NCUA, HUD and the FTC). Twelve of […]Read More »Centralized Regulation: A Closer Look at Janet Yellen’s Recent Remarks

Janet Yellen, Chairwoman of the Board of Governors of the Federal Reserve, recently gave a speech that questioned Wall Street’s ethics and culture – and hinted at an overall approach to regulation that should have compliance officers taking note. To quote Ms. Yellen “…the Fed also promotes safety and soundness by seeking to ensure that […]Read More »What Compliance Officers Can Learn from JPMorgan Chase

In a recent filing with the Securities and Exchange Commission, JPMorgan Chase reported that it has been questioned by the U.S. Department of Justice regarding possible racial disparities in loans the bank purchased from auto dealers. While the report does not mention whether the bank is the target of the probe or simply participating in […]Read More »Another Lesson in Fair Lending: First United Bank of Texas

Background The First United Bank of Texas (FUB) is a $1.2 billion FDIC regulated subsidiary of Plains Bancorp operating in western Texas (Dimmitt, TX). The FDIC/DOJ investigations found the Bank charged Hispanic applicants 205 basis points (BPs) more than non-Hispanic applicants for unsecured consumer loans. After performing a regression analysis, the basis point differential between […]Read More »Compliance Officers: Earning a Seat at the CEO’s Table

At the most recent ABA Compliance Conference one session focused on how compliance officers get invited to the table with other key management. When asked this question, the CEO of Ally Bank looked at the audience of compliance officers and said “You earn it.” Few people in a financial institution are as well-positioned to “earn […]Read More »