Fair Lending Best Practices

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.

Managing Discretionary Pricing Risks

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here.Read More »

How to Assess Redlining Risk by Analyzing Peers

By Arthur R. Preiss, Ph.D. and Philip B. Preiss Unless you’ve been hiding under a rock, you know that redlining is a key focus of the regulators in 2017. Redlining is the practice of discouraging applicants or denying loans in specific geographic locations. This article discusses one aspect of how a bank should assess its […]Read More »

How Model Risk Management Can Play a Leading Role in Compliance

By Arthur R. Preiss, PhD., and Stephen E. Sudhoff, CFA Models help us think about our world in a structured way. As credit products have become more complex and computing power has become cheaper and more accessible, analysis of more complex relationships has become easier. And, as our world has become more complex, our need for […]Read More »

What Is a Peer Bank?

What is a peer bank? A seemingly simple question that has become anything but simple to answer. Peer banks are a hugely important item that can vastly affect the portrayal of your institution, and thus it is paramount that when you define an institution as a “Peer Bank,” you are identifying the correct organization. There […]Read More »

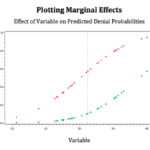

An Introduction to Fair Lending Marginal Effects for Financial Institutions

Keep up to date with the latest news and insights from Preiss and Associates. Sign up for our e-newsletter here. Read More »

Marginal Effects: You May Not Know Me But Your Regulator Does

Marginal effects are a regression-based process, used for many years as an analytical tool. The Consumer Financial Protection Bureau (CFPB) has been and continues to use marginal effects in its fair lending exams. Aside from the fact that regulators utilize marginal effects in their exams, financial institutions may choose to use marginal effects in their […]Read More »

Understanding the CFPB’s Expectations through Enforcement

Once a quarter, the Consumer Finance Protection Bureau publishes a report of actions it’s taken to enforce compliance matters across the spectrum of consumer finance products. This report, called Supervisory Highlights, often contains valuable insights into how the Bureau is collecting, interpreting and acting on the data it collects. And according to Director Richard Cordray, […]Read More »

Peer! Peer! Who Is Your Peer?

The Fall 2016 edition of the Consumer Finance Protection Bureau’s Supervisory Highlights devoted several pages to the topic of redlining. Some of what the CFPB had to say about fair lending was not new—for example, that “redlining is a priority area in the Bureau’s supervisory work” or that “redlining is a form of unlawful lending discrimination under […]Read More »

REMA: Reasonably Expected Market Area

Recently I attended a seminar where a Federal Deposit Insurance Corporation representative used the term “REMA” in a discussion of redlining risk. Have you heard the term? It’s a helpful acronym to know if you desire to understand how the FDIC makes determinations about redlining. What follows borrows heavily from the FDIC representative’s comments on REMA. Reasonably […]Read More »

Overdraft Protection Violations: A Check-in for Compliance Officers

In April the Consumer Finance Protection Bureau announced that Regions Bank had signed a Consent Order regarding Overdraft Protection violations. While overdraft programs are not exactly front burner issues for most compliance officers, there are some noteworthy findings in this case that compliance officers would do well to give some consideration. Overdraft Protection Violations After […]Read More »

Consumer Compliance & Fair Lending Trends: Kansas City Federal Reserve

Beginning on April 7, the Federal Reserve Bank of Kansas City will hold a series of forums to discuss several regulatory compliance hot topics including trends in consumer compliance. The recently released Powerpoint presentation provides some insight into the Fed’s supervisory focus for the coming year. (You can view the presentation here.) The forums will be […]Read More »

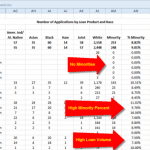

Finding Fair Lending Focal Points Using Excel

Though there are numerous software options available to help you keep track of your fair lending focal points, Excel can be a powerful tool if you know how to use it. Follow these easy steps to keep track of your loan products using a pivot table. What is a Focal Point? Fair Lending Focal Points are Each Potential Combination […]Read More »

A Survival Strategy: What Can Regression Analysis Do For You?

“Monitoring is not an option”- a quote from a speaker at the recent American Bankers’ Association (ABA) fair lending conference in reference to fair lending monitoring. In today’s fair lending compliance environment, compliance officers are besieged with new regulations as well as new requirements for old regulations. How do you survive? Multiple strategies are probably […]Read More »

What Is Bayesian Improved Surname Geocoding (BISG)?

BISG and Other Proxies: What Is BISG and Why Proxies Matter to All Banks? BISG, which is the CFPBs newest method of determining race and ethnicity proxies, is the acronym for Bayesian Improved Surname Geocoding. Like many other analyses in fair lending, BISG is borrowed from another research area. In this case BISG, in […]Read More »

Small Bank Signs Intent Decree for Fair Lending Complaint

Fort Davis State Bank: Elements of a Small Bank Monitoring Program Recently Fort Davis State Bank (FDSB) of Fort Davis, Texas a $78 million three branch institution signed a consent decree with the Department of Justice. The DOJ complaint, based on an FDIC referral, alleged that FDSB charged Hispanic borrowers more for unsecured loans than […]Read More »

FDIC Fair Lending Hot Topics Teleconference 12/18/12

FDIC Fair Lending Topics Teleconference Earlier this week the FDIC held one of their Banker Teleconference Series on Fair Lending Topics. The teleconference was broken into four sections: an overview of the fair lending exam process, criteria interviews and statistical analysis, third party providers and fair lending risk and best practices. You can find […]Read More »