This week the Department of Justice published its Equal Credit Opportunity Act or ECOA annual report to Congress. Some of the data in the report makes for interesting reading.

A Look at the Numbers

For 2014 DOJ received 18 referrals from the various agencies (CFPB, FDIC, FRB, OCC NCUA, HUD and the FTC). Twelve of the 18 cases resulted in DOJ investigations while 6 cases were sent back to the referring agency. Viewed another way, if a case gets referred to DOJ, the odds are 2:1 that there will be a DOJ investigation. Of the 18 cases referred to DOJ, 15 (83%) came from the CFPB. The other 3 cases originated by the FDIC. The Fed, OCC, NCUA, FTC and HUD did not refer any cases to DOJ in 2014.

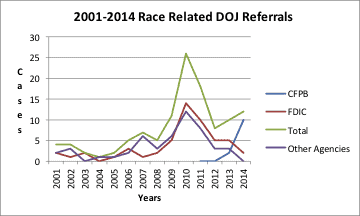

The graph below provides a long term perspective on DOJ referrals. It shows the referrals peaked in 2010 (49 cases). The number of referrals has trended down in the last four years. It’s interesting to note that for the majority of the period 2001 – 2014, the FDIC has been the major source of DOJ referrals. In 2014 the CFPB assumed that title. After the CFPB (in recent years) and the FDIC (during the whole period), the Fed was the most prolific source of referrals, sending 56 cases to the DOJ.

Race Related Referrals

A second table in the report indicates how many of the referrals shown above are race related cases. In total there were 115 (28%) race related cases out of a total of 412 cases for the years 2001-2014. As the graph below shows, until the advent of the CFPB, the FDIC was again the major source of referrals to DOJ. The Fed referred 21 race related cases over the whole period which was 38% of their referral total (56) for the period.

Open Investigations

Lastly, the DOJ indicated that there were 25 open investigations at the end of 2014. The cases were in areas familiar to compliance officers. Discrimination based on race and national origin are being investigated in the following fair lending areas:

- Underwriting or pricing of mortgage loans including discretionary interest rate markups and fees; Pricing of unsecured consumer loans and vehicle secured loans;

- Pricing of indirect auto and motorcycle loans including discretionary interest rate markups (This category also includes potential discrimination based on age and gender according to the DOJ report);

- Redlining of minority neighborhoods; and

- Discrimination based on disability in the underwriting of mortgage loans.

In summary, compliance officers should get ready for another action-packed year. If we at Preiss&Associates can be helpful to you, please contact us.